Time:2020-04-01 Reading:9641

The COVID-19 pandemic is sweeping the world, threatening human health and impacting the global economy. It has become the biggest "black swan" event in recent years. As the lifeblood of the national economy, the global and Chinese energy industry has inevitably been greatly affected. In response to the epidemic crisis, China has adopted the strictest control measures in the world. Since late January, factory shutdowns and traffic closures have severely affected China's industrial production and economic activities. As the world's largest energy producer and consumer, China's energy demand, supply and development prospects will have a great impact on the world. In addition, China is a global manufacturing power, playing a pivotal role in the global industrial chain, and the stagnation of energy supply and demand will also cause a chain reaction worldwide. As the global epidemic worsens, more and more countries have begun to vigorously implement containment policies, and even block borders and international travel, which will have a great impact on the global energy industry and the flow of commodities. To this end, internationally renowned consulting institutions and think tanks are closely following the progress of the COVID-19 epidemic and have made analysis and forecasts on the impact of the outbreak on the supply and demand of fossil energy in China and the world, the development of new energy industry and climate action. We will continue to present some core views of foreign think tank reports. Today, we publish Wood Mackenzie's report analyzing the impact of COVID-19 on China's commodity market.

Wood Mackenzie: The coronavirus pandemic will lead to a decline in China's commodity demand

Supply chain disruptions combined with labor

shortages will keep factory capacity utilization at low levels in the coming

weeks even as companies gradually resume production, with implications for

commodity markets, according to an analysis published on March 6 by consultancy

Wood Mackenzie. China's steel demand is expected to fall by 2.5% to 5% this

year, with a surplus of thermal coal in China putting downward pressure on

domestic and international thermal coal markets in the short term, while a

shortage of met coal supplies is causing prices to rise for imported met coal.

1. the

extent of the decline in steel demand is unclear

Chinese steel demand is expected to fall by

only 1% this year as companies return to work and government incentives are

introduced. But there are many uncertainties, such as a drop in incomes during

the pandemic, which could affect people's ability to spend once they resume

work. It is also unclear whether the government will invest more in

steel-intensive infrastructure or shift the budget to healthcare and

compensation for businesses. Based on these factors, steel demand could fall by

2.5% to 5% for the year as a whole.

China's crude steel production is expected

to fall 2.4 per cent this year. So far, China's steel production has not been

seriously affected by demand. But that looks set to change, as Wood Mackenzie

recently surveyed 20 steel producers. These producers have halted production

due to high inventories of finished steel and shortages of raw materials. As

demand wanes, steelmakers may not increase capacity utilization. Weak demand

and logistics constraints have led to a surge in steel inventories, which will

not be immediately depleted until demand picks up, even if logistics issues are

addressed.

2.

short-term oversupply of thermal coal will put downward pressure on the market

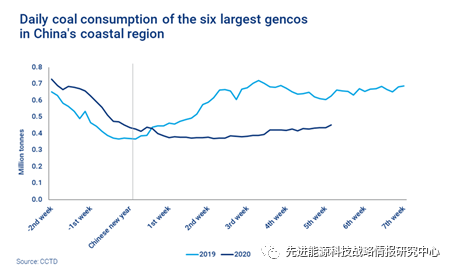

Nearly 78 percent of China's power

generation capacity has resumed operations, and capacity utilization rate has

continued to recover to 65 percent, double the level at the beginning of this

month, the National Energy Administration said. At the same time, demand for

thermal coal is also increasing, but at a much slower pace than supply, leading

ports and power companies to accumulate inventories, putting downward pressure

on the price of thermal coal at Qinhuangdao port. Hit by China's coal

oversupply, Newcastle Port 5,500 high-ash coal and Indonesian coal prices will

fall to their lowest levels in April and then remain low until the end of the

first half of the year. This will in turn push down the Newcastle 6,000 coal

price, which is expected to average $67 / ton in 2020. The coronavirus outbreak

is already underway in Europe, however, ARA coal prices have fallen to the cost

line, so are likely to remain stable. Continued low LNG prices in Europe, as

well as its strong renewable power generation, will keep a lid on coal prices.

Figure 1 Daily consumption of thermal coal

for power generation in coastal areas of China, 2019-2020 (million tons)

3.

Metallurgical coal supply shortage will improve by mid-March

China's domestic metallurgical coal supply

is in short supply due to manpower shortages and transportation restrictions

caused by epidemic control measures, and the impact on supply has been

exacerbated by the mining accident in Shandong province. Mongolia's imports

have slowed since the closure of its borders in February. Shortages in

Australia and Canada have maintained tight supply conditions for seaborne

trade. Metallurgical coal supplies have been constrained through mid-January

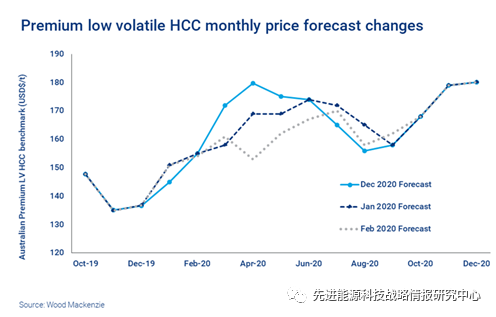

and February. Australian spot prices for premium low-volatile hard coking coal

averaged US $155 / ton in February this year, up from US $151 / ton in January.

The price broke above US $162 / ton on the last trading day due to reduced

supply of high-quality coal in late February. High steel inventories will begin

to limit blast furnace production, and coal supplies are expected to improve

from mid-March. Metallurgical coal prices are likely to reach lows in April as

coal supplies normalize and Mongolia reopens its borders. An increase in steel

demand in May-July as construction sites restart will help meet coal prices.

There are likely to be a lot of incentives in China from the second quarter of

2020 onwards, so while the impact of the virus may persist overseas this year,

sea freight prices will rise significantly by the end of the year.

Figure 2 Australian premium low volatile

coal monthly price forecast (US $/ tonne)

Quote from